annual federal gift tax exclusion 2022

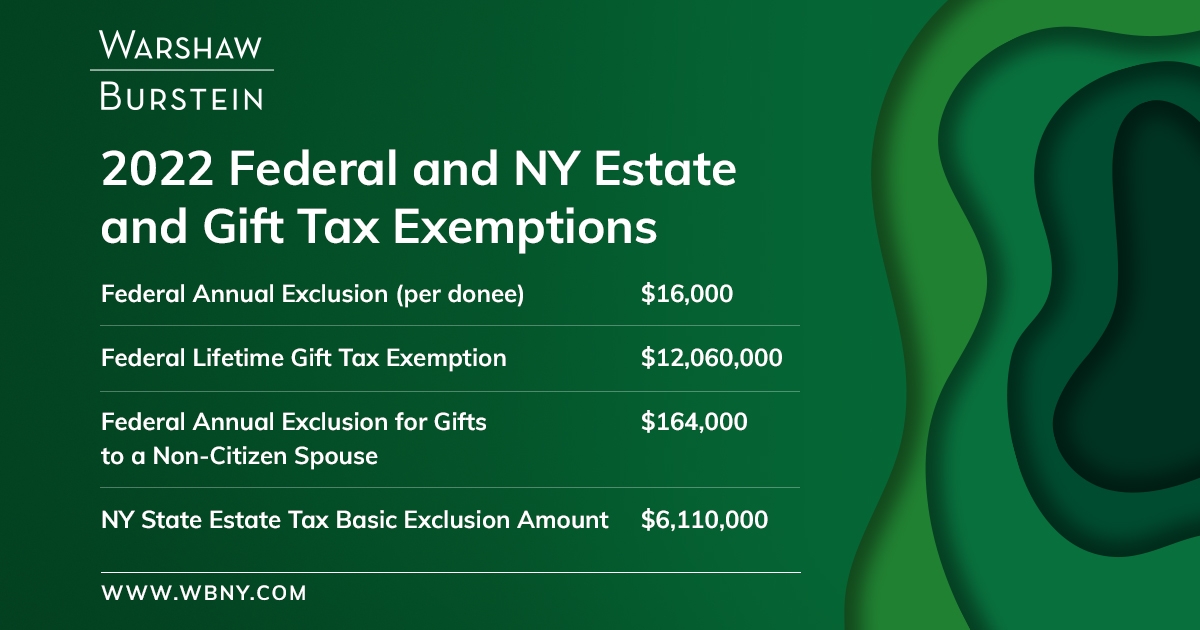

The gift tax annual exclusion in 2022 will increase to 16000 per donee. What is the gift tax annual exclusion amount for 2022.

What Is The Gift Tax Exclusion For 2017 Cipparone Zaccaro

The federal government imposes a tax on gifts.

. However as the law does not concern itself with trifles 1 Congress has permitted donors to give a small amount to each beneficiary of their choosing before facing the federal gift tax. Tax and Estates Alert. As the gift and estate tax are unified this is also the estate tax exemption for decedents who die in 2022.

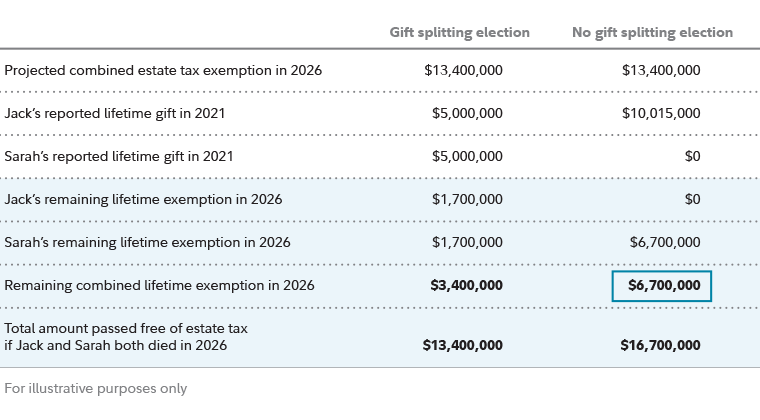

Also a husband and wife may split a 32000 gift for tax purposes before there is a gift tax. The IRS clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after 2025 when the exclusion amount is scheduled to drop to pre-2018 levels. This means that someone can give 15000 to any person in a calendar year 30000 for a married couple without having to file a federal gift tax return and without it counting toward their lifetime.

Giftestate tax lifetime exemption increases from 117 million to 1206 million. The lifetime gift tax exclusion is shared with the estate tax which means the more money you give above the annual gift. You dont actually owe gift tax until you exceed the lifetime exclusion which is 1206 million in 2022.

The federal estate tax exclusion is also climbing to more than 12 million per individual. In the case of gifts other than gifts of future interests in property made to any person by the donor during the calendar year the first. The annual part of the exclusion means you could gift 15000 on December 31 and another 16000 on January 1 without incurring tax because the gifts would occur in two separate years.

In 2022 the annual gift tax exemption is 16000 up from 15000 in 2021 meaning a person can give up 16000 to as many people as they want without having to pay any taxes on the gifts. 2022 Annual Gift Tax Exclusion will increase to 16000. Please visit the Estate and Gift taxes page for more information regarding federal estate and gift tax.

Annual Gift Tax Exclusion. In addition to the annual exclusion increase the IRS announced that the federal lifetime gift tax exemption will increase to 12060000 as of January 1 2022. Starting in 2022 currently proposed legislation would reduce the annual gift tax exclusion to 10000 per year per donee recipient.

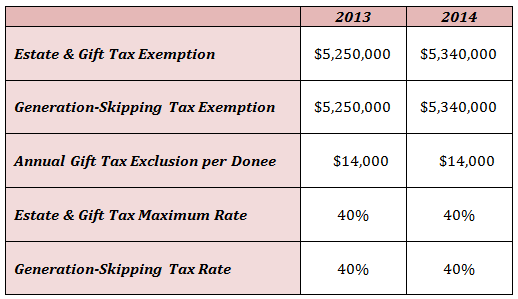

It increased the exclusion from 549 million to 1118 million. For 2018 2019 2020 and 2021 the annual exclusion is 15000. The federal estate- and gift-tax exemption applies to the total of an individuals taxable gifts made during life and assets left at.

The tax will also come due if you cumulatively exceed the exclusion amount. In other words if you give each of your children 11000 in 2002-2005 12000 in 2006-2008 13000 in 2009-2012 and 14000 on or after January 1 2013 the annual exclusion applies to each gift. In 2022 you can give 16000.

The term taxable gifts means the total amount of gifts made during the calendar year less the deductions provided in subchapter C section 2522 and following. Wednesday March 2 2022. The gift tax annual exclusion allows taxpayers to make certain gifts without eroding the taxpayers lifetime exemption amount.

How the gift tax is calculated and how the annual gift tax exclusion works. Itll also limit the donor to 20000 annual exclusion gifts in total. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.

Or a 5000000 federal estate tax exemption with full step-up in tax cost. The exclusion is portable and this means that a surviving spouse. In 2021 you can give up to 15000 to someone in a year and generally not have to deal with the IRS about it.

Code 2503 - Taxable gifts. Although there is near-universal acceptance of the importance of gifting. The IRS allows individuals to give away a specific amount of assets or property each year tax-free.

In addition the estate and gift tax exemption will be 1206 million per individual for 2022 gifts and deaths up from 117 million in 2021. The gift doesnt have to be made in one lump sum. There have been inflation adjustments each year since then and in 2022 the exclusion is 1206 million.

So if youre looking to give some large gifts its likely a good idea to do so before new limits go into effect. The annual exclusion for 2014 2015 2016 and 2017 is 14000. You need to file a gift tax return using IRS Form 709 any year in which you exceed the annual exclusion.

This means a person can give any other person at least 16000 before it is subject to the federal gift tax. Gift tax annual exclusion increases from 15000 to 16000. The maximum rate of the federal estate tax is 40 percent so it can have a significant impact on your legacy.

Now that we are firmly into 2022 there are a number of federal tax changes to consider before making gifts. 2022 and 2021 Federal. This exclusion is up from 15000 per person in 2021.

In 2022 the annual exclusion for Federal Gift Taxes increased to 16000 per person per year. The GST exemption also is adjusted to 12060000 in 2022. This amount is known as the annual exclusion amount which for 2022 is 16000 per beneficiary.

For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly. 3 The exclusion is doubled to 2412 million for married couples. This is the total amount1206 million for 2022youre able to give away tax-free over the course of your lifetime above the annual gift tax exclusion.

Gift tax is a federal tax on money or assets you give that are worth more than the annual exclusion of 16000 in 2022. Annual Gift Tax and Estate Tax Exclusions Are Increasing in 2022 The amount you can gift to any one. Generation-skipping transfer tax lifetime.

How To Make The Most Of The Annual Gift Tax Exclusion Cpa Firm Tampa

Projected Increases In 2022 For The Gift Tax Annual Exclusion Amount And Lifetime Exemption Preservation Family Wealth Protection Planning

Warshaw Burstein Llp 2022 Trust And Estates Updates

Estate Planning Strategies For Gift Splitting Fidelity

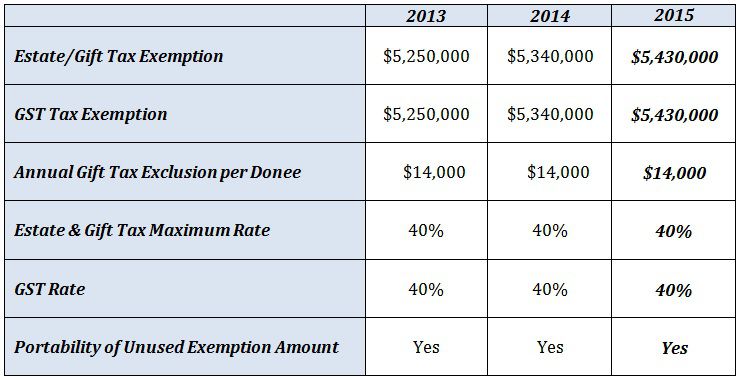

2013 2014 Estate Gift Gst Exemptions Rates The Ashmore Law Firm P C

New Higher Estate And Gift Tax Limits For 2022 Couples Can Pass On 720 000 More Tax Free

Gift Tax How Much Is It And Who Pays It

What Is The Tax Free Gift Limit For 2022

How Does The Gift Tax Work Personal Finance Club

Annual Gift Tax And Estate Tax Exclusions Are Increasing In 2022

Historical Estate Tax Exemption Amounts And Tax Rates 2022

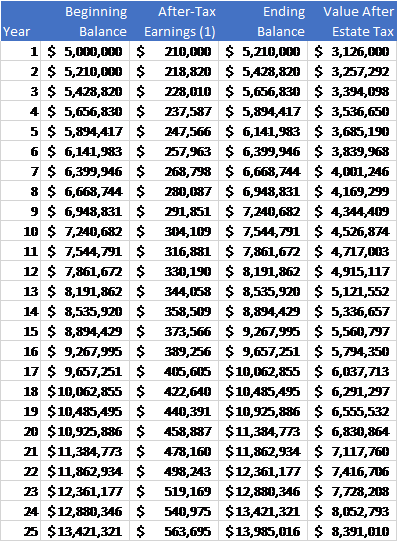

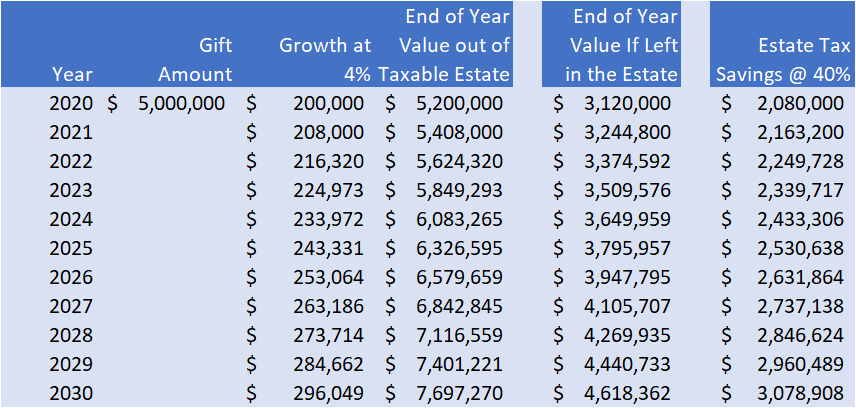

Gifting Time To Accelerate Plans Evercore

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

2015 Estate Gift Generation Skipping Tax Exemptions The Ashmore Law Firm P C

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Gift Tax Explained 2022 And 2021 Exemption And Rates Smartasset

Annual Gift Tax Exclusion Vs Medicaid Look Back Period Cornetet Meyer Rush Stapleton

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

What It Means To Make A Gift Under The Federal Gift Tax System Agency One